Predict Loan Default using ML

Project Overview

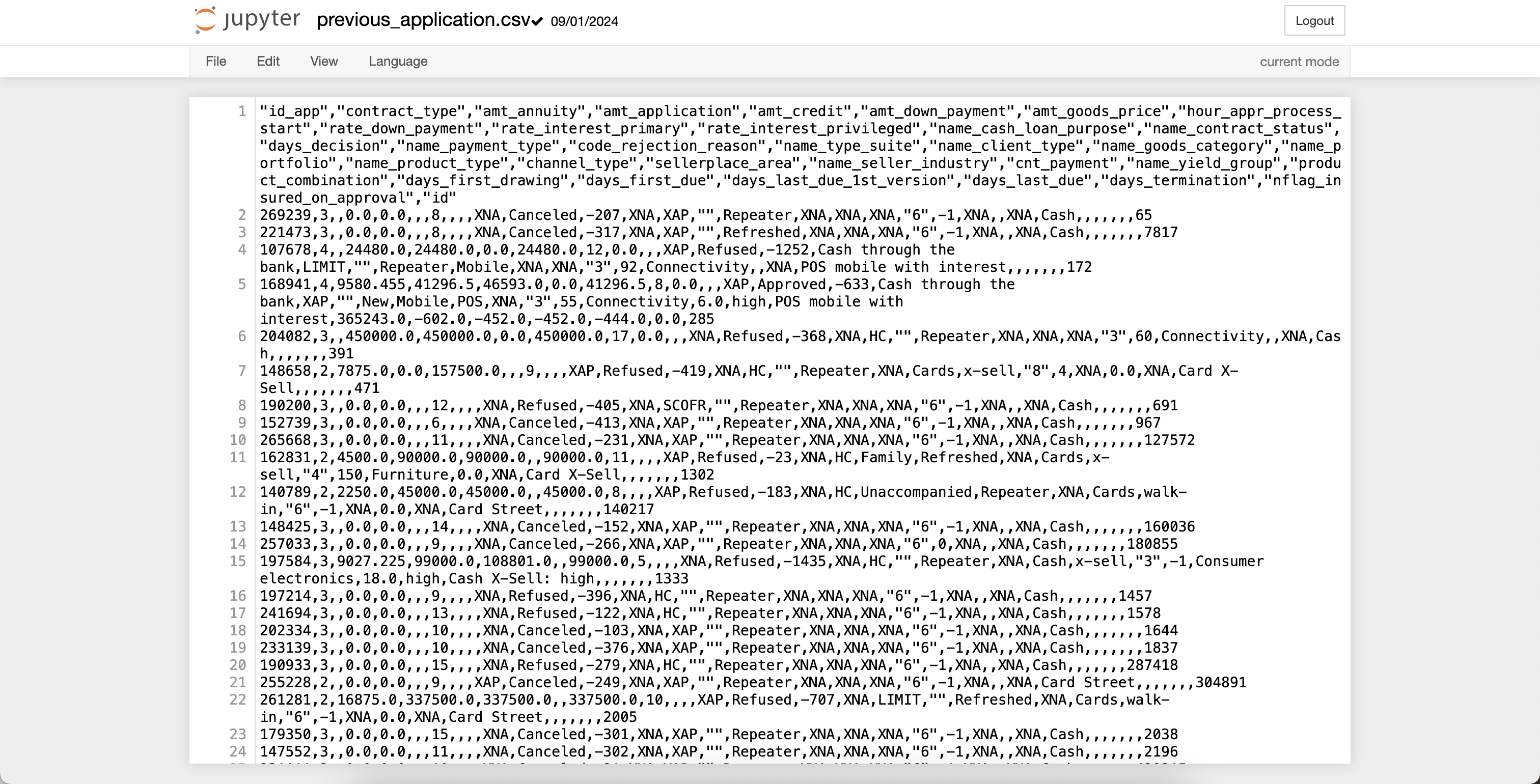

The company, which offers unsecured mortgages and consumer credit to customers, plans to implement a digital transformation strategy to optimize operating costs and enable rapid risk assessment, currently collects a large amount of data on past customers and delinquencies, and wants to predict the likelihood of Loan defaults for current applying customers.

My Job

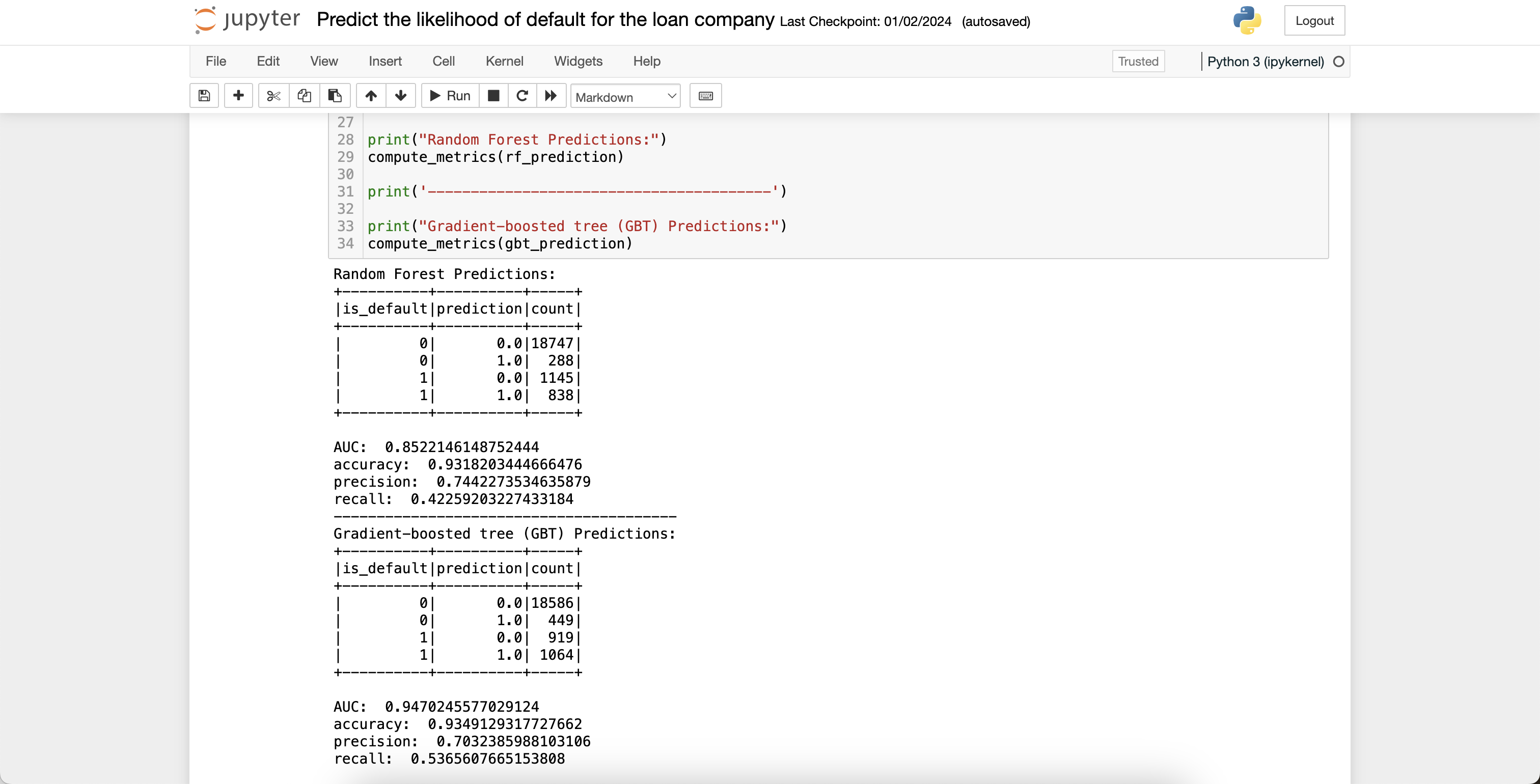

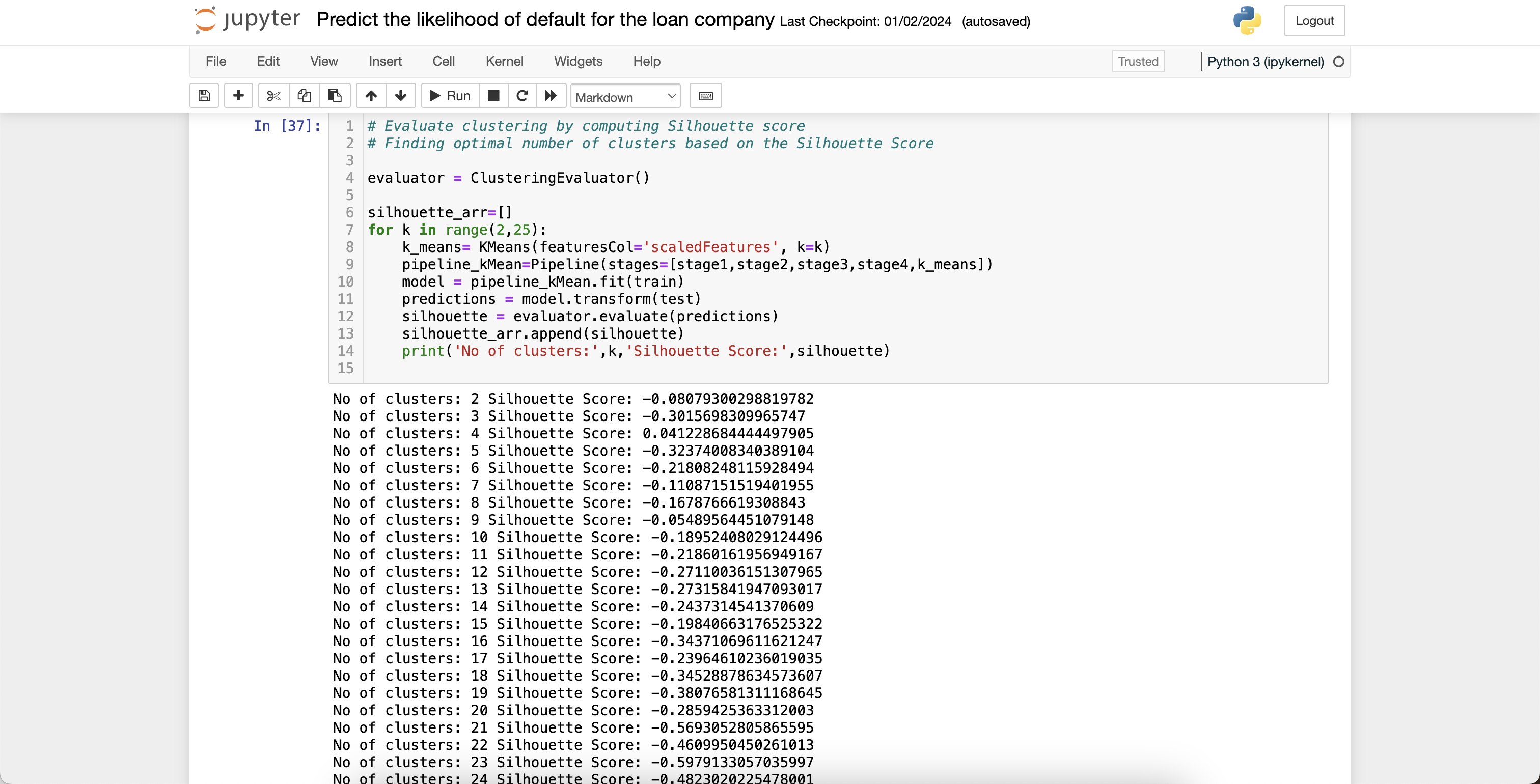

Work independently, spark was used to process big data, and random forest and GBT were used to build prediction models, and the quality of the models was evaluated. In addition, the K-Mean clustering algorithm is used to classify all the people who apply for loans.

Project information

- Category: data

- Client: Monash Loan Comany

- Project date: 15 Jan 2024 ~ 22 Jan 2024

- Project Tech: Spark,Machine Learning

- My Role: Data Engineer